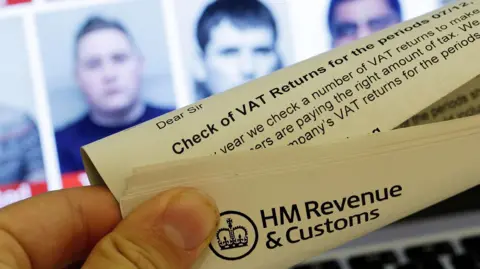

In a notable revelation concerning cybercrime, the HM Revenue and Customs (HMRC) has reported that a staggering £47 million was unlawfully siphoned from the accounts of approximately 100,000 individuals through a sophisticated phishing attack. This alarming breach of security has raised significant concerns about the vulnerability of online taxpayer accounts, thereby prompting an immediate response from HMRC.

The tax authority, tasked with overseeing tax collection and implementing certain regulatory functions in the United Kingdom, has assured those affected by the cyber theft that it is reaching out to confirm that their accounts have been secured. They maintain that no financial losses were incurred by the individuals whose accounts were compromised—rather, the fraudsters aimed to unlawfully claim money from HMRC itself by masquerading as genuine taxpayers. This distinction is crucial as it underscores HMRC’s proactive approach in addressing the issue, ensuring that the public retains confidence in their services.

In response to the situation, HMRC has reiterated that they are actively investigating the matter, having already made several arrests related to the incident in the previous year. This indicates a level of seriousness that underscores the agency’s commitment to combating fraudulent activities and improving the security of taxpayer information. The assurances extended to the public are also indicative of the systemic efforts being undertaken to fortify cybersecurity measures within the agency.

The phishing attack employed by these criminals highlights the sophistication with which scammers operate, using advanced techniques to extract sensitive customer details as part of their scheme. The essence of their strategy revolved around attempting to claim rebates that were not rightfully theirs. Angela MacDonald, the deputy chief executive of HMRC, conveyed this information during an evidence hearing, stating that the amount taken was substantial and categorically unacceptable. Her remarks bring to light the ongoing struggle that authorities face in countering such illegal acts.

Moreover, during the hearing, members of the HMRC committee faced criticism from Members of Parliament (MPs) for failing to inform the Treasury Committee about the fraud as it was happening. This raises questions about transparency and accountability within HMRC. It also emphasizes the need for regulatory bodies to act decisively and promptly when dealing with security breaches to restore public trust.

Following the cyber theft, the HMRC has taken considerable steps to thwart further incidents. Efforts included identifying and locking down the compromised accounts to prevent additional fraudulent transactions. This response illustrates not only a reactive measure but a dynamic outlook that is essential in today’s rapidly evolving digital landscape, where the threats from cybercriminals are ever-present.

The incident serves as a stark reminder of the vulnerabilities that can exist within even the most robust government systems. It brings to the fore the importance of cybersecurity in safeguarding sensitive financial information and reinforces the need for constant vigilance in the face of advancing technology and evolving threats. The current climate calls for enhanced collaboration between public bodies and cybersecurity experts to devise comprehensive strategies to mitigate similar risks in the future.

In conclusion, the £47 million loss attributed to this phishing attack signifies a significant breach that has affected thousands of individuals in the UK. The HMRC’s prompt action in securing accounts and its candid communication with the public highlights a strong commitment to restoring order and integrity to its operations. Continued efforts to enhance cybersecurity measures will be paramount, ensuring that taxpayer information remains safeguarded in an increasingly digital world.