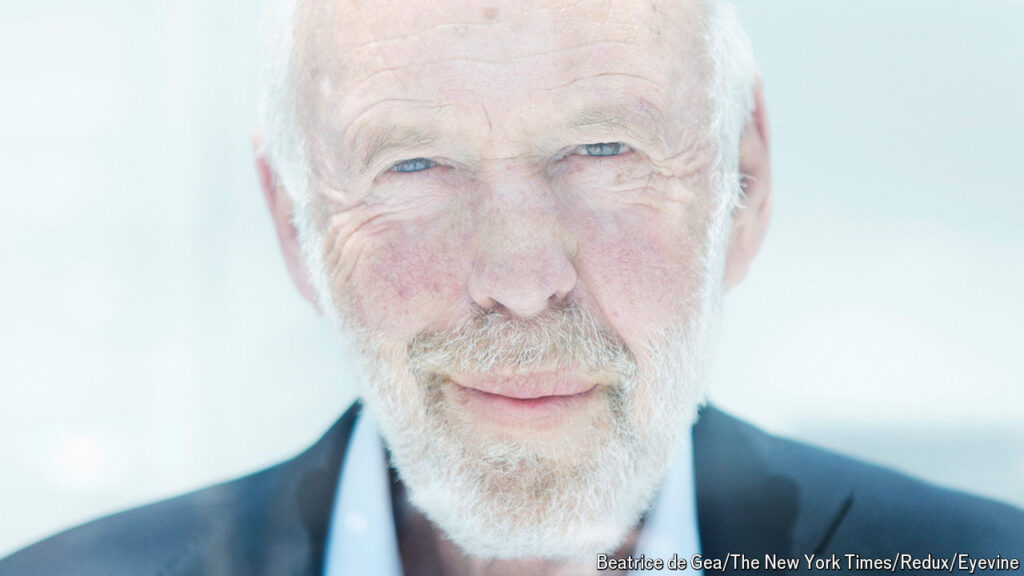

Jim Simons was not always destined to be a financial wizard. Born in 1938 in Newton, Massachusetts, he showed an early aptitude for mathematics. After earning a doctorate in mathematics from the University of California, Berkeley, he worked as a codebreaker for the National Security Agency and taught at the Massachusetts Institute of Technology. It was not until he was in his 40s that he turned his attention to finance.

In 1978, he founded Renaissance Technologies, a quantitative hedge fund that would revolutionize the industry. Using complex mathematical models and algorithms, Renaissance was able to predict market movements with uncanny accuracy. This allowed the firm to generate massive profits, far outpacing the returns of traditional investors like Buffett and Soros.

One of the key factors behind Renaissance’s success was the Medallion fund, a secretive and exclusive investment vehicle that only accepted money from employees of the firm. The fund’s stellar performance was due in large part to Simons’s innovative approach to trading. While other investors relied on gut instinct and market trends, Simons used sophisticated statistical analysis to identify profitable opportunities.

But Simons’s success was not without controversy. Critics questioned the ethics of Renaissance’s trading strategies, which some argued were too opaque and relied too heavily on mathematical models. The firm also faced legal challenges, including a lengthy dispute with the IRS over its use of complex tax-avoidance schemes.

Despite these challenges, Simons’s legacy as one of the greatest investors of all time remains secure. His unique blend of mathematical prowess and market intuition set him apart from his peers, earning him a reputation as a true pioneer in the world of finance. His impact on the industry is still felt today, as quant trading continues to grow in popularity and influence.

In conclusion, Jim Simons’s life and career are a testament to the power of innovation and perseverance in the world of finance. His remarkable success as an investor and entrepreneur has cemented his place in history as a true legend of the industry. While his methods may have been unconventional, his results speak for themselves. Jim Simons will be remembered as a trailblazer who forever changed the way we think about investing.