In the sweltering summer of July 1998, Stan Fischer found himself in a rather precarious situation, despite being on what was supposed to be a leisurely vacation at the picturesque Martha’s Vineyard. The number-two official at the International Monetary Fund (IMF), Fischer was, instead, deeply engrossed in urgent negotiations to orchestrate a financial bailout for Russia. This country, burdened with mounting economic chaos and deemed “too nuclear to fail,” required immediate assistance to avert catastrophic repercussions not only for itself but also for the global economy.

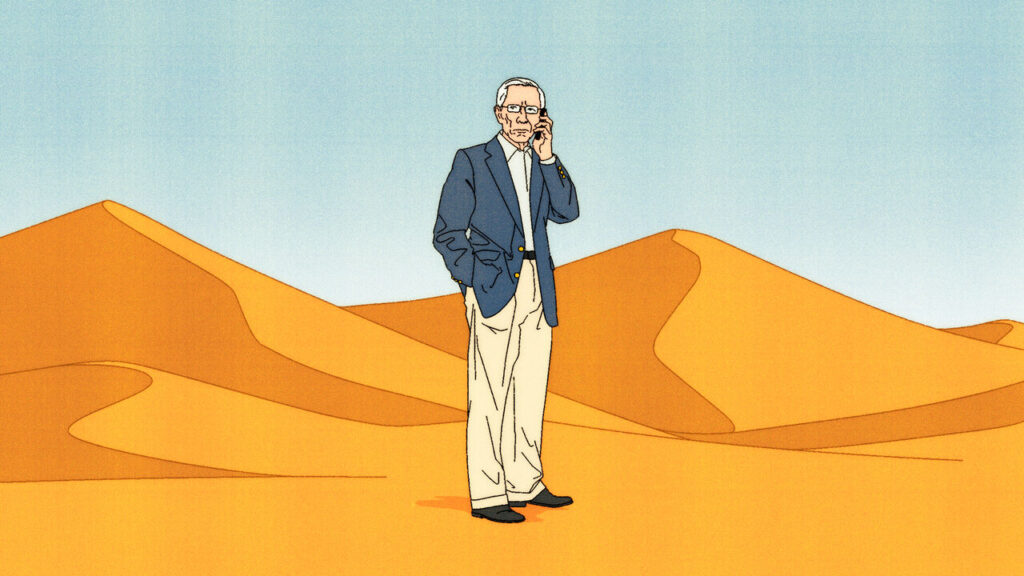

As Fischer perched on a sand dune, his mobile phone glued to his ear, the dissonance of the scene became clear. He was in a location synonymous with relaxation and leisure, surrounded by idyllic beaches and sunbathers, yet his mind was anchored in the tumultuous world of international finance. His wife, observing the ridiculousness of the situation, assured him of how out of place it all seemed. The juxtaposition of Fischer’s holiday surroundings and the weighty discussions on global economic stability highlighted the extraordinary demands placed on leaders in times of crisis. They could not escape their responsibilities, even in the most serene of settings.

The IMF itself was at the forefront of this complex scenario, tasked with providing financial support to countries on the verge of collapse. Fischer’s involvement wasn’t merely professional; it was emblematic of the IMF’s role as a global financial watchdog. The organization, often criticized for its stringent conditions and policies, was faced with the urgent need to address the burgeoning crisis in Russia, where economic disarray threatened to spill over and destabilize not just the nation, but also its neighbors and the wider international community.

Russia’s situation in 1998 was dire. Economic reforms initiated during the post-Soviet era had faltered, leading to hyperinflation, a crumbling currency, and a banking system on the brink of total failure. The stakes were higher than ever, given Russia’s extensive nuclear arsenal which, in the eyes of the world, made its stability a non-negotiable priority. The implications of a financial collapse in Russia were profound: the potential for political instability, increase in global arms proliferation, and an influx of refugees could alter geopolitical dynamics drastically.

As Fischer continued his negotiations, his ability to navigate this labyrinthine crisis would be tested to its limits. The talks involved not just financial aid, but also the necessity to implement reforms that would stabilize the Russian economy while maintaining political order. The challenges were immense; any misstep could lead not only to economic turmoil but also exacerbate existing tensions in a region that had only recently emerged from the shadows of the Cold War.

During such a pressing period, it was crucial for Fischer and the IMF to effectively communicate the urgency of the situation to international stakeholders. Engaging with world leaders, economic strategists, and political figures was integral to garner the support necessary for a successful bailout. The IMF needed to put forth a cohesive plan that not only addressed immediate financial assistance but also offered a roadmap toward sustainable economic recovery in Russia.

The global implications of Fischer’s negotiations were abundantly clear. If the IMF failed to act decisively, the repercussions would ripple through international markets and could potentially usher in a new era of instability. As he sat on that dune, his wife’s words echoed in his mind—a reminder of the absurdity of mixing vacation with the heavy burden of global responsibility. Yet, such was the life of an international finance leader during an unprecedented crisis, where the lines between personal time and professional obligation were often blurred in the pursuit of stability in an increasingly interconnected world.