The U.S. Department of Justice has made significant strides in combatting the rising wave of cryptocurrency scams, notably through the recent seizure of over $225 million in digital assets tied to fraudulent investment schemes. This operation marks a historic moment for law enforcement, being the largest seizure to date related to what are often termed “crypto confidence” scams. These scams manipulate unsuspecting individuals into investing in dishonest cryptocurrency schemes, primarily targeting American citizens.

According to the Justice Department, these scams have impacted more than 400 victims globally, causing significant financial losses, particularly among Americans. A newly unsealed complaint outlines that the perpetrators executed “hundreds of thousands” of transactions aimed at laundering the illicitly acquired cryptocurrency. The sheer volume of transactions highlights the sophisticated nature of these criminal enterprises, as they deftly navigate the digital landscape to obfuscate their activities.

The seizure of these funds is a pivotal step towards returning some of the stolen assets to the victims, as noted by Shawn Bradstreet, a Special Agent at the Secret Service. During a news conference, he communicated the government’s commitment to recovering these losses, which have surged alarmingly in recent years. Victims reported nearly $4 billion in cryptocurrency-related investment losses in 2023, a marked increase from approximately $2.57 billion in 2022, with projections estimating losses could surge to $5.8 billion by 2024.

The alarming statistics underscore the gravity of the situation, with law enforcement agencies like the Federal Bureau of Investigation (FBI) and the Secret Service intensifying efforts to alert the public about the potential devastations caused by such scams. Tragically, as reported by CNN, individuals such as an elderly American man recently took their own lives after losing their life savings to scammers, highlighting the profound human impact behind these financial crimes.

A significant number of these crypto confidence scams, colloquially known as “pig butchering,” are orchestrated by organized crime networks based in Southeast Asia. Investigations, including a dedicated report by CNN, traced some of these fraudulent schemes back to large complexes situated along the Myanmar-Thailand border. Interestingly, some of the illicit activities have also been linked to operations in the Philippines, indicating a broader geographic scope of these criminal activities.

Bradstreet emphasized that these scams exploit human trust, often leading to harsh financial consequences for victims. This growing trend emphasizes the need for increased awareness and preventive measures as criminals continue to devise ingenious methods to defraud unsuspecting individuals.

The recent crackdown on crypto scams is also viewed as a positive development among U.S. law enforcement, especially following concerns raised about the commitment of the current administration in addressing these rampant illegal activities. An April memorandum from Deputy Attorney General Todd Blanche suggested that the Biden administration might resort to prosecutions to impose regulations within the crypto industry. This memo raised fears among some law enforcement officials that the shift in administration might lead to reduced efforts against crypto-related fraud.

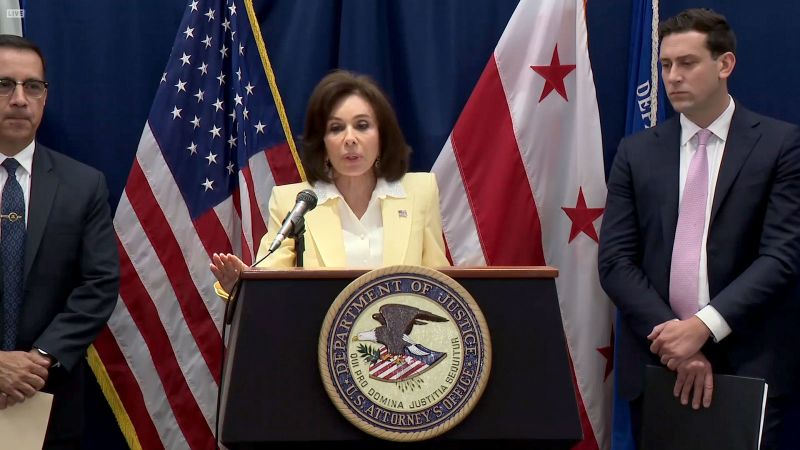

In addition, the dissolution of the Justice Department’s National Cryptocurrency Enforcement Team, set up in 2022 to target criminal abuses involving cryptocurrency, has sparked apprehensions regarding the trajectory of the government’s anti-fraud initiatives. Despite these challenges, Jeanine Pirro, the interim U.S. Attorney for the District of Columbia, reasserted at the recent news conference that prosecutors remain dedicated to pursuing these scammers.

Describing the crypto landscape as an “unregulated Wild West,” Pirro called attention to the extensive reach and varied methods employed by criminals in this space, indicating a vivid and unpredictable terrain for both law enforcement and potential investors to navigate. The multifaceted nature of these operations underscores the necessity for stringent regulations and proactive policing to protect consumers from future scams. As this saga unfolds, the battle against cryptocurrency fraud continues, its significance escalating along with the digital economy itself.