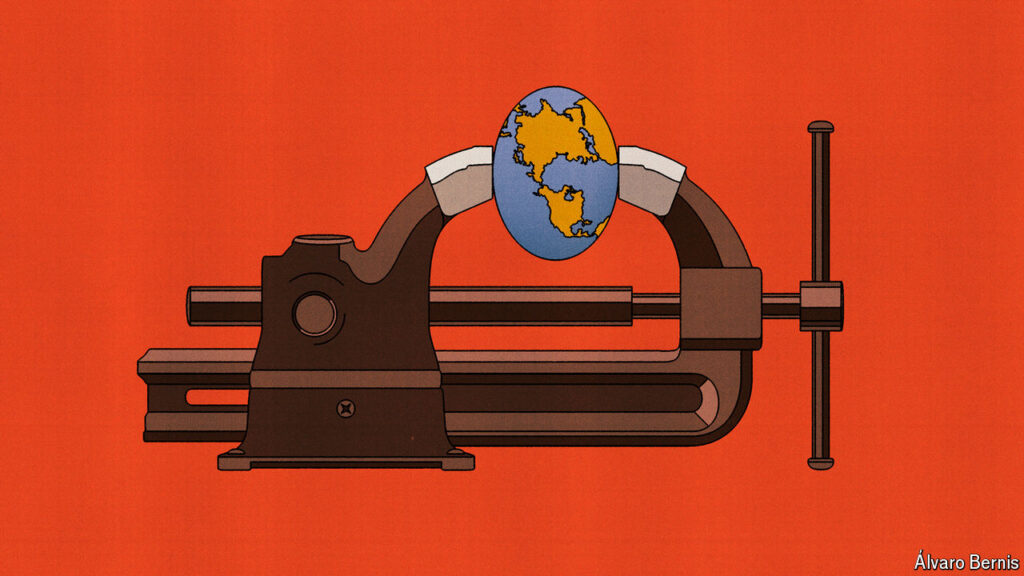

It has been four years since the initial wave of poor countries faced default due to escalating expenses from dealing with the effects of the covid-19 pandemic and investors withdrawing capital from volatile markets. Additionally, it has been two years since the increase in interest rates in developed countries further intensified the financial strain on cash-strapped governments. Despite these challenges, at the recent spring gatherings of the IMF and the World Bank in Washington, DC, many global policymakers seemed to be under the impression that the worst of the debt crisis, affecting a significant portion of the world’s population, had passed. This optimism was fueled by the fact that the world’s poorest nations experienced a commendable 4% growth rate last year, with some countries, like Kenya, even resuming borrowing on the international stage.

However, the reality is that the debt crisis continues to persist. The governments that had previously defaulted have yet to successfully restructure their debts and regain financial stability, leaving them in a state of uncertainty and vulnerability. Furthermore, there remains a looming risk that more nations, of increasing size and significance, could find themselves in a similar predicament in the future. In light of these ongoing challenges, amidst the various social gatherings and discussions at the spring meetings, the IMF’s board made a pivotal announcement regarding a new and innovative approach to address the crisis.

This announcement signifies a pivotal moment in the ongoing efforts to address the global debt crisis, which has been exacerbated by the unprecedented challenges posed by the covid-19 pandemic and the ensuing economic repercussions. The inability of many governments to effectively manage their debts and navigate the complexities of the financial landscape has raised concerns about the stability of the global economy and the potential ripple effects that could arise from the persistence of the crisis.

As the IMF and the World Bank convene to strategize and collaborate on solutions to the debt crisis, it is essential to acknowledge the multifaceted nature of the challenges at hand. From the need for comprehensive debt restructuring mechanisms to the importance of proactive economic policies and sustainable development strategies, there is a complex web of factors that must be addressed to ensure the long-term stability and prosperity of nations around the world. Additionally, the role of international cooperation and solidarity cannot be understated, as the interconnected nature of the global economy requires a coordinated and collaborative approach to effectively address the challenges posed by the debt crisis.

In conclusion, the recent developments at the spring meetings of the IMF and the World Bank underscore the pressing need for innovative and bold approaches to address the global debt crisis. While progress has been made in some areas, there remains a long and challenging road ahead to secure the stability and prosperity of nations worldwide. By working together and embracing new ideas and solutions, the international community can overcome the challenges posed by the debt crisis and pave the way for a more resilient and sustainable future for all.